What is Triple Bottom Line

The article was written by Sara Pantaleo.

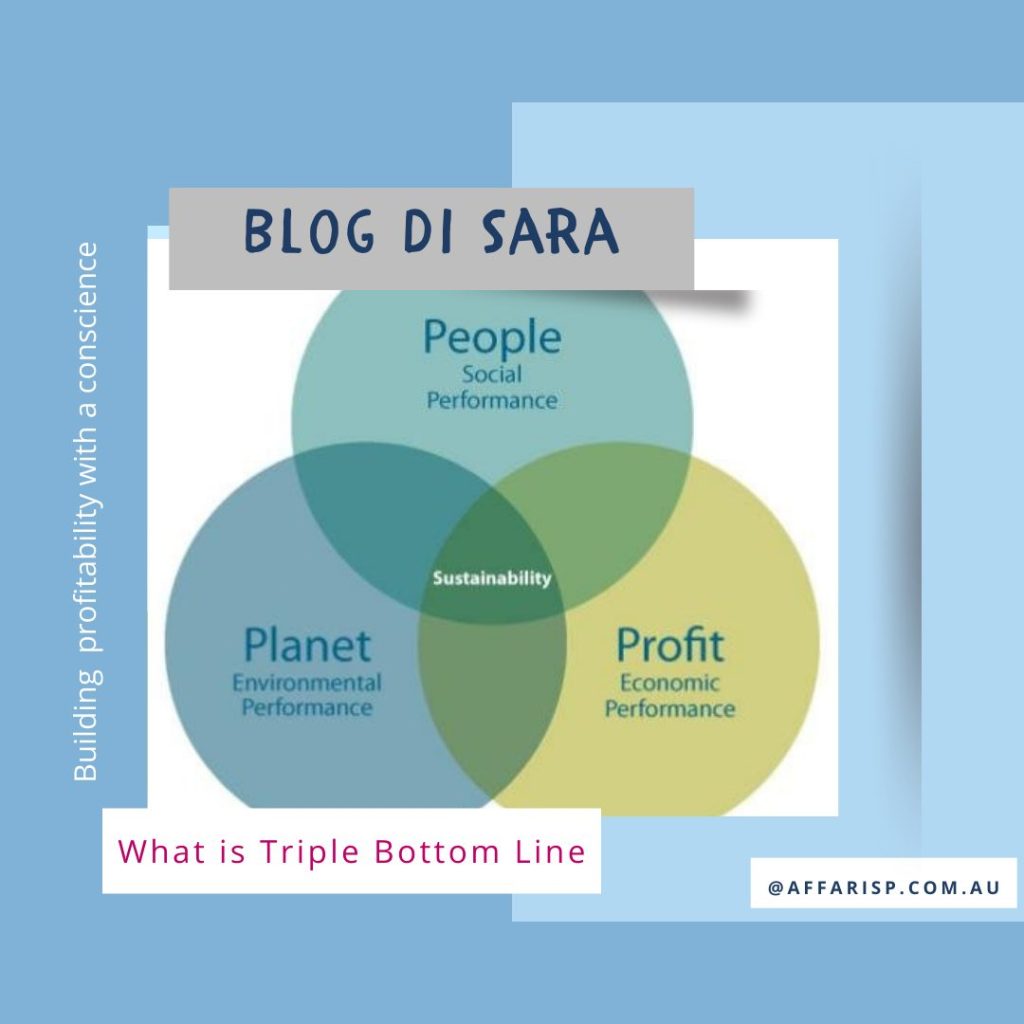

What Is the Triple Bottom Line?

The Triple Bottom Line (TBL) is a way of measuring an organisation’s impact on its social and environmental effects in addition to financial performance.

Purpose-led organisations find that using triple bottom line to monitor more than just the financial performance helps them improve how they treat people both within and outside the organisation and reduce their adverse impact on the environment.

John Elkington first explained the triple bottom line in his 1999 book, “Cannibals With Forks: The Triple Bottom Line of 21st Century Business.” It’s a bottom line that continues to measure profits, but also measures the organisation’s impact on people and the planet”.

The triple bottom line expresses an organisation’s impact and sustainability on both a local and a global scale.

The concept behind the triple bottom line is that organisations are responsible first and foremost to all their stakeholders, including everyone involved with the organisation, whether directly or indirectly, and the planet we’re all living on.

The standard bottom-line infrastructure is based on profitability. However, the triple bottom line includes social, environmental and economic impacts that might affect an organisation instead of using profit and economics as the driving force.

The shareholders are part of the stakeholder group, but not the only factor.

So, some critical trends support the need for organisations to be more socially aware and responsible:

- Organisation’s imperative for success in hiring, motivating and retaining good people. At the extreme, think of leading sports teams or media organisations, in which the people earning big money are the stars, not the shareholders. These organisations need to be focused on their people.

- Good people are in short supply. Baby Boomers are moving out of the workplace into retirement, and there are fewer people in the following generations. The impact of COVID19 border restrictions has escalated this problem further. Organisations that don’t look after their workforces will quickly find they can’t attract and retain the right people they need.

- While earlier generations may have tolerated impoverished conditions at work, people in the new generations are likely to be looking for more meaning. Unless they find this meaning, they’ll move on.

- Consumers and potential recruits have many more choices than they had in the past and are more aware of large companies’ ethical and environmental stance—some base their purchase and career decisions on these things.

Triple bottom line is also expressed as “People, Planet, Profit.”

The Three Ps of the Triple Bottom Line

People, Planet and Profit

People

Organisations fostering the triple bottom line way of doing business think about their actions on all the people involved. This can include everybody from farmers supplying raw materials, customers, employees and up to the CEO of the business. Every one’s well-being is taken into consideration. The organisation offers a flexible working environment, reasonable working hours, foster diversity and inclusion, a healthy, safe workplace, and opportunities for advancement and education. It does not exploit their labour force (using child labour or offering sweatshop wages).

In some cases, the “people” bottom line can also include the company’s community.

While the people’s bottom line concept is undoubtedly attractive, the difficulty comes in deciding how far you go. Do you apply it to employees? Their families? Suppliers?

Planet

Triple bottom line organisations focus on reducing or eliminating their ecological footprint. They strive for sustainability, recognising that “going green” may be more profitable in the long run. But it’s not just about the money.

Triple bottom line organisations look at the entire life cycle of their actions and determine the actual cost of what they’re doing regarding the environment. As a result, they ensure they reduce their energy usage, dispose of any toxic waste safely, use renewable energy sources, and don’t produce unsafe or unhealthy products for people and the planet.

Profit

The financial bottom line is the one that all organisations share, whether they’re using the triple bottom line or not. When looking at profit from a triple bottom line standpoint, the idea is that profits will help empower and sustain the community as a whole and not just flow to shareholders.

People – How an organisation engages and develops its employees and its impact on people.

- For example, how do the mines in Western Australia affect the surrounding communities and the benefit the organisation offers employees.

Planet is related to the environmental footprint of the organisation.

- Such as energy use or waste footprint.

Profit is the standard method of measuring profit and loss in accounting principles.

The Triple Bottom Line in Practice

While you may or may not consider the Triple Bottom Line appropriate for your business, it makes sense to recognise how the workplace is changing and consider whether you need to adapt your approach to business to reflect this.

If you decide to explore the concept further, start by researching what other companies are doing to change the way they do business positively. Looking at the steps they’ve taken will save you time brainstorming on ways to improve your own business. Some examples from different industries include:

- An international shipment and packaging company has reduced its ecological footprint by having 30 per cent of its stores use renewable energy.

- A food business sets goals to reduce its carbon dioxide emissions by 10 per cent over the next few years. Investigate using more environmentally friendly ways to package products and set targets to reduce waste.

- A coffee company only buys its beans from farmers who grow coffee environmentally friendly and ensures that all its workers are treated fairly and receive a living wage for their skills.

- A computer company focuses a lot of its community efforts on training and education programs. It helps underprivileged kids by giving them access to technology and has goals to recycle a percentage of its annual waste.

By taking the time to start using the triple bottom line approach, you might be surprised at just how positive the reaction will be from your colleagues and your customers.

What can you do for your business to work towards a TBL model?

The Triple Bottom Line is essentially a reporting system. But, in itself, it doesn’t improve the company’s impact on people or the environment any more than the action of producing a set of management accounts would affect profits.

However, it can drive improvements in how an organisation impacts people and the environment by helping leaders focus on what they need to do to improve all of the bottom lines and keeping this work high on their agendas.

The B-Corp certification is an excellent way for a larger organisation to ensure you’re incorporating people, plane, profit into your business. The impact assessment and getting certified hold you to a standard of TBL verified by the B-Corp framework.

If you are a small business, don’t try to do it all at once. Instead, pick one or two initiatives, execute them well, and create a TBL mindset from leadership to all stakeholders. For instance, try to reduce waste and introduce environmental measures like saving energy or offsetting carbon emissions if you are a trucking business.

Some tangible initiatives you can implement:

| PEOPLE

| PLANET

| PROFIT

|

Your Organisation’s Community Impact

Your profits shouldn’t come at the expense of people and the planet.

Imagine working every day for an organisation you are genuinely excited about and proud to be a part of.

Sure, the pay is decent, and there’s childcare, but those aren’t the only reasons why you love working there.

You’re proud to be a part of this organisation because they’re honourable.

They stand out from the typical “cut-throat” business world by the way they treat suppliers, the community, their commitment to environmental sustainability, their ethical investments, and their desire to empower and promote their team members instead of dragging them down.

There is a constant air of excitement and possibility, and you love coming to work each day.

Triple Bottom Line (TBL) is not at profit’s expense, but more to incorporate other measures into an organisational health profile. Businesses must be financially healthy and prosperous for People and Planet to thrive.

All three must work in unison to fulfil its Triple Bottom Line goal.

What is Triple Bottom Line Read More »